With a waiting list of more than 500,000 potential investors before its debut, Robinhood is perhaps the only mobile-online trade platform that earns praise and vehemently evokes controversy. Today, the app has more than 10,000,000 users who buy, sell, trade and invest in stock without a commission fee. But is Robinhood legit and safe to use?

Robinhood is legal because the platform is a member of the Securities Investor Protection Corporation (SIPC). You get fund protection for cash claims up to $250,000 and $500,000 for securities. In addition, Robinhood is a securities brokerage company regulated by the Securities and Exchange Commission.

This guide covers Robinhood in-depth. Specifically, you’ll learn what Robinhood is, the types of accounts on the platform and so much more.

Let’s get to it.

What is Robinhood Exactly?

Founded by Vladimir and Baiju Bhatt in 2013, Robinhood is a personal brokerage investment app created to eliminate firms that charge customers high commission on every transaction.

Robinhood had at least 500,000 people on the waiting list before it launched. And it has grown to become one of the platforms in the financial investment niche to have more than 10 million registered users, with many of these accounts active every month.

The platform features over 650 stocks on the global exchange, which are via crypto, gold, and ADRs.

One of the things that really stand out about Robinhood is that the team behind it teaches you about investment basics with educational articles found in the “Learn” section of the platform. They also have a customer service that supports customers 24/7.

Robin Hood isn’t the broker service you want to go for if you are in search of a broker that offers IRA (Individual Retirement Accounts).

What Types of Accounts are on Robinhood?

Any new sign-up qualifies for a Robinhood Instant Account. From there, you can upgrade to Robinhood Cash Account or Robinhood Gold.

Brokers are to pay a monthly fee of $5 for extra features like more margins and Morningstar featured in the free package for the American brokers.

Below is a brief explanation for each type of Robinhood account:

1. Robinhood Cash Account

Brokers are not restricted by the pattern day trading rules as they do day trading. The cash account also does not have a margin.

There are at least two obvious limitations of the Robinhood cash account.

- Brokers have to wait for days to use their proceeds after reporting a sale.

- The cash account does not have instant deposits and it will take 4 to 5 days to transfer money.

2. Robinhood Instant Account

The Robinhood Instant Account is ideal for brokers who prefer instant deposits. At the time of this writing, the Robinhood Instant Account gives you an instant deposit of up to $1,000.

Unlike on Cash Account, brokers don’t have to wait for 3 days for settlement and you can invest your proceeds right after making sales. However, do keep in mind that, unlike with Cash Account, this account type has a limited day trading.

3. Robinhood Gold Account

Robinhood allows users to make instant deposits but up to $5,000.

This upgrade provides brokers with so much trading power because it is a true margin account. Brokers with this account can also access NASDAS level II, which is a live market data.

You will also find powerful research tools such as the Morningstar, which will offer you insightful trade recommendations.

Robinhood Gold doesn’t charge interest in the $1,000 on debt margin, but Pattern Day Trading rules restrict Day Trading and a monthly fee of $5 is charged.

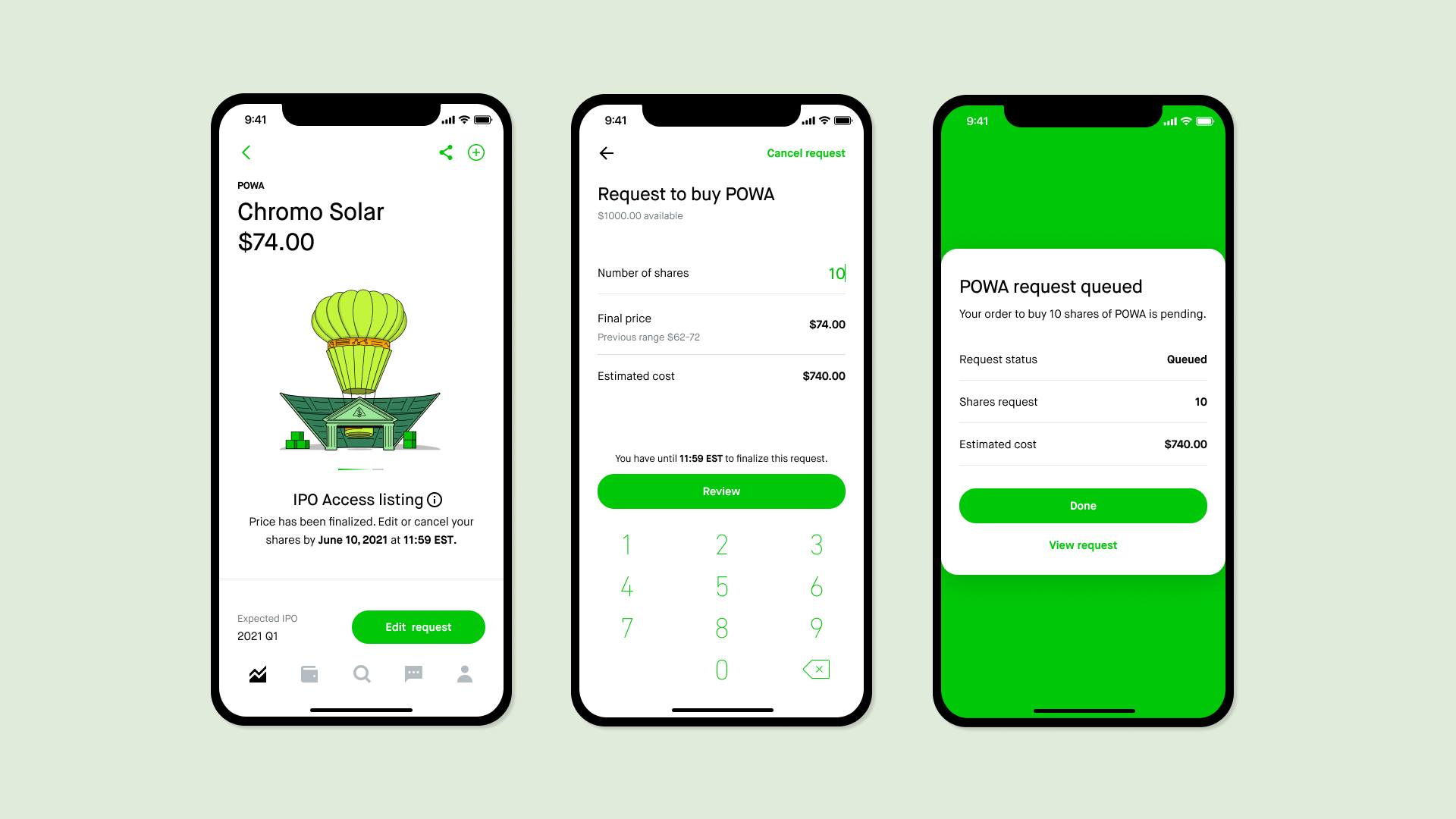

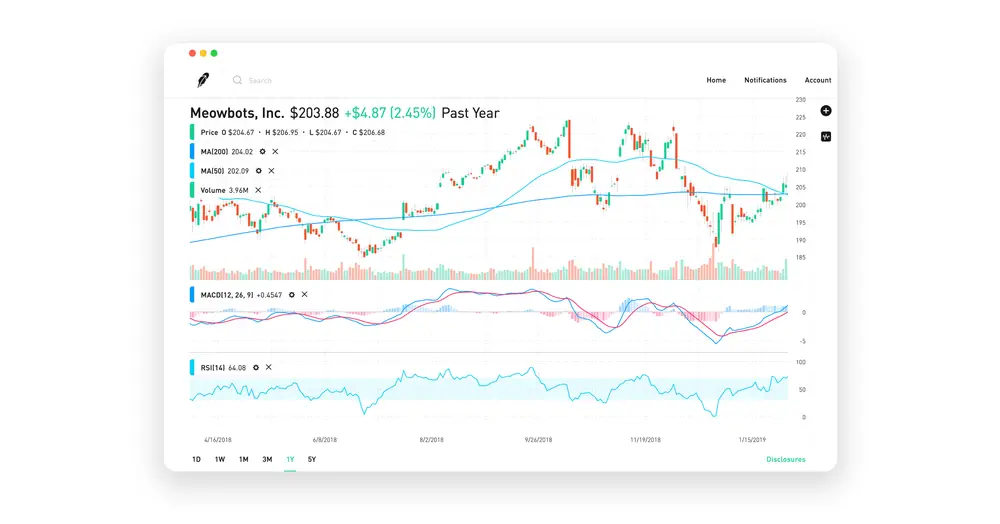

Charting on Robin Hood

Apart from the technical indicator available on a click, the broker app offers brokers past price results of the stocks they want to trade on.

Robinhood charts analyses are not so detailed. So, if chart details are one of your priorities, this broker app may not suit you.

Stock Loan Programs and Margins on Robinhood

Robin Hood gives rise to revenue for its brokers by lending margin guarantees to counterparties. All the benefits derived from loaning your broker stock are exclusively for Robinhood.

Compared to Average Margin Interest, the Margin Interest Rates on Robinhood is way too low. Interested brokers need to upgrade to the Gold program to get the experience.

Range of Offers on Robin Hood

It’s important to note that Robinhood has a limited number of offers. It only offers ETFs, crypto trading, and stock options. So, this is not the app to consider if you want to trade futures, commodities, and forex. Again, the app does not support fixed income products and mutual funding.

With Robinhood, you can invest in stocks that are long selling, single and multi-leg options, crypto including BTC (Bitcoin), BCH (Bitcoin Cash), BSV (Bitcoin SV), DODGE (Dogecoin), ETC (Ethereum Classic), ETH (Ethereum) and LTC (Litecoin)

Can You Transfer Stocks Robinhood?

It’s possible to transfer stock in and out of Robinhood.

As a broker on the platform, you can send out stock fast, but doing so will cost you $75 for every transaction.

Income stocks are free.

How to Open an Account with Robinhood

It’s easy to open an account on Robinhood. It should take you roughly 10 minutes to complete the application process.

To get started:

- You must be 18 years or older to qualify for an account

- Download the Robinhood app. Download the app here if you use an Android smartphone and here if you use an iPhone.

- Submit an online application via their app

The details you will provide during registration include financial data, tax ID, and a legal residential address.

It takes Robinhood less than 24 hours to activate a broker account. After Robinhood activates your account, you’ll need to provide additional information, such as date of birth and Social Security Number.

You will also give answers to brief questions, which helps Robinhood to learn and understand your trading experience.

Finally provide a photo of your ID card, passport, or driver’s license to verify your identity

What is the Minimum Deposit on Robinhood?

Robinhood does not have a minimum deposit amount for Instant account users. Those on the Gold tier have a minimum deposit a minimum of $2,000.

How to Withdraw Earnings from Your Robinhood Account

There is nothing as interesting as withdrawing what you earn on Robinhood. Here are the steps to follow:

- Find the account icon located at the bottom right of your screen

- Choose the Transfers option

- Select the option to transfer to your bank

- Choose the bank account to which you want the money deposited

- Enter the amount of money you want to send to your bank account

- Hit the submit button and wait for your request to process

It’s that simple!

Is Robinhood and Safe to Use?

In our eyes, and the many thousands of investors who’ve risked their money to invest in this app, Robinhood appears to be a legit and safer platform to trade in. At least there are a number of regulatory boards that keeps Robinhood on its toes, so they try to do things right.

Robinhood is the right brokerage to consider if you are new to the investing game. At least you get the opportunity to learn the basics of investment as you trade on the platform.

The site also has over 10 million users and that means it is something trustable – or at least we think that the number of active users on the platform is a strong reflection of the brand’s trustworthiness.

If you don’t have much to spend but you are still eager to trade, Robinhood is the best option because it is cheap. After all, the brokerage app doesn’t charge a commission.

What You’ll Like about Robin Hood

Here are things we found quite interesting about this trading platform:

1. Crypto

Robinhood offers users a cryptocurrency trading option. Robinhood is therefore the right option for people who want to associate themselves with digital currencies.

2. The Cash Management Account

The company offers cash management accounts to users, which currently pays brokers 0.30%.

Apart from providing you with a debit card, the account also offers free ATM withdrawal at more than 75,000 ATMs.

3. Cost

Robin Hood is one of the cheapest brokerage companies in existence. The company might not be as robust as other companies in the business are, but its discounts are genuine.

4. Streamlined Interface

The Robin Hood interface is too accessible to even inexperienced users. Which means it is super easy to use. The brokerage is highly convenient for brokers whose goals are dabbed to stocks.

What We Don’t Like About Robinhood

The following are some of the things that we feel Robinhood should have addressed – or should consider addressing:

1. Lacks Retirement Accounts

It only offers taxable brokerage accounts to its users. So you do miss tax benefits for retirement accounts if you choose to invest with Robinhood. To enjoy the tax benefits of retirement, consider brokerage accounts like Roth IRAs and Traditional.

2. A More Wanting Customer Support

Although several improvements have been made to customer support, the customer support experience is still not as good as it is supposed to be.

Final Thoughts: Is Robinhood Legit?

Robinhood is a legit platform, but it isn’t without its misgivings.

To be very clear, the agency has fronted lawsuits, regulatory fines, and public scrutiny. For example, back in 2020, Security and Exchange Commission fined the company $65 million for misleading its customers.

A year later (2021), Robin went ahead and mislead its users once again and FINRA (Financial Industry Regulator Authority) penalized them a fine of $70 million.

The same year, one of its users, named Alex Kearns aged 20, committed suicide after seeing an inaccurate negative balance of $730,000.

So should you use the platform?

It’s really up to you to decide. Investment is a risky business at its best and we recommend that you proceed with caution when using this kind of a platform.

Robinhood is a securities brokerage company regulated by the Securities and Exchange Commission and is a member of the Securities Investor Protection Corporation (SIPC).

Robinhood is a legitimate trading platform that has gained popularity among investors for its commission-free trades and user-friendly interface. However, like any financial platform, there are risks associated with investing, and users should educate themselves on these risks before investing their money.