Effective budgeting and cost tracking are important pillars of financial success. By understanding your income, spending patterns, and savings goals, you can make informed decisions to reach your financial goals.

That’s why we’ll take a look at carefully selected budgeting and spending tracking tools to suit a variety of needs and lifestyles. Whether you’re a tech-savvy millennial or someone who prefers the simplicity of pen and paper, there’s a tool on this list for you. Let’s dive in!

1. Personal Finance Apps:

Modern life demands convenient solutions, and personal finance apps are at the forefront of helping individuals manage their money. These apps are available on various platforms and offer a range of features, from expense tracking to investment tracking. Here are some popular options:

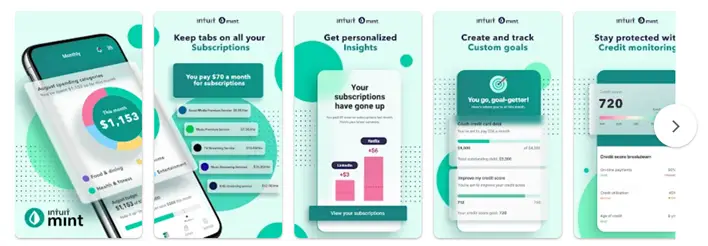

a) Mint:

Mint is an all-in-one personal finance app that connects to your bank accounts, credit cards, and investment accounts. It automatically categorizes your expenses, provides budgeting insights, and sends alerts for upcoming bills.

b) YNAB (You Need A Budget):

YNAB follows a proactive budgeting approach, encouraging users to assign every dollar a job. Its philosophy revolves around “giving every dollar a purpose,” leading to better financial decisions and eliminating overspending.

c) PocketGuard:

This app focuses on helping you maintain a balanced budget. It shows your “pocket” (available spending money) after accounting for bills, savings, and financial goals.

d) Personal Capital:

Geared towards investment tracking and retirement planning, Personal Capital offers robust tools for those looking to grow their wealth while keeping their expenses in check.

2. Envelope Budgeting Systems:

If you prefer a more hands-on approach to budgeting, the envelope system is a traditional yet effective method. In this system, you allocate cash to different envelopes representing various spending categories. As you spend money, you physically remove cash from the corresponding envelope. When an envelope is empty, you know you’ve reached the limit for that category.

While this system can be replicated using actual envelopes, several digital tools now offer virtual envelope budgeting:

a) Goodbudget:

With Goodbudget, you can create virtual envelopes and allocate funds to different categories. The app syncs across devices and allows sharing with family members for collaborative budgeting.

b) Mvelopes:

Like Goodbudget, Mvelopes offers digital envelope budgeting with added features like bill payment and debt management.

3. Spreadsheet-Based Tools:

For those who prefer the flexibility of spreadsheets and want complete control over their budgeting process, spreadsheet-based tools are ideal. These tools allow you to customize your budgeting and expense tracking method according to your unique needs.

a) Microsoft Excel/Google Sheets:

The classic spreadsheet software allows you to create personalized budget templates or use pre-made ones available online. You can track expenses, analyze trends, and visualize your financial progress using charts and graphs.

b) Tiller Money:

Tiller Money is a Google Sheets add-on that automatically imports your financial transactions, saving you the trouble of manual data entry. It offers various budgeting templates to suit different styles.

4. Automated Savings Apps:

Saving money is a crucial aspect of budgeting, but it can be challenging to set aside funds consistently. Automated savings apps are designed to make saving effortless:

a) Acorns:

Acorns round up your everyday purchases to the nearest dollar and invest the spare change. It’s a micro-investing app that helps you grow your savings passively.

b) Digit:

Digit analyzes your spending patterns and automatically transfers small amounts to a savings account based on what you can afford.

c) Qapital:

Qapital allows you to set up personalized savings rules, like saving a specific amount when you hit a step goal or spending at certain stores.

5. Receipt Scanning Apps:

Keeping track of receipts can be cumbersome, but it’s essential for tracking expenses and potential tax deductions. Receipt scanning apps digitize and organize your receipts, making expense tracking a breeze:

a) Expensify:

Primarily designed for business expense tracking, Expensify can also be used for personal finance. It scans receipts, categorizes expenses, and generates expense reports.

b) Shoeboxed:

Shoeboxed is dedicated to organizing receipts. You can mail your physical receipts, and they will scan and upload them to your account.

6. Bill Negotiation Services:

One way to free up extra money in your budget is to reduce bills, such as cable, internet, or insurance. Bill negotiation services specialize in negotiating better rates with service providers on your behalf:

a) Billshark:

Billshark negotiates with bill providers to lower your bills and save you money on services like cable, internet, and wireless plans.

7. Community-Based Budgeting:

For some, accountability and support from like-minded individuals can significantly improve budgeting success. Community-based budgeting tools offer a sense of camaraderie and shared goals:

a) Honeydue:

Honeydue is a budgeting app designed for couples to manage their finances together. It allows both partners to track spending, view budgets, and communicate about money matters.

Onward to financial success!

No matter your financial situation or budgeting preferences, there’s a budgeting and expense-tracking tool to suit your needs. Whether you opt for a sleek personal finance app, an envelope system, or a DIY spreadsheet, staying consistent and committed to your financial goals is key.

Remember, budgeting isn’t about restricting yourself; it’s about empowering yourself to make informed choices, reduce financial stress, and work towards a more secure and prosperous future. So, pick the tool that resonates with you the most, start budgeting today, and take the first step toward financial success!

FAQ

Reputable budgeting apps implement strong security measures to protect your financial information. Look for apps that use encryption and industry-standard security protocols. Additionally, read reviews and check the app’s privacy policy to ensure your data is being handled responsibly.