Many people live with the notion that the more money you make the more comfortable your life can get. And with the cost of living fluctuating from state to state and time to time, it’s possible to wonder whether a $70,000 salary is decent. So is 70K a good salary?

Whether 70K is a good salary depends on you. Examine your lifestyle, spending habits, demography, investments, and saving habits to determine if $70,000 gross income would be sufficient to live on annually. Keep in mind that how much you take home as net income depends on your tax bracket.

A survey by the Bureau of Labor Statistics shows that, as of 2021, the median salary for all US workers currently stands at $1,028 per week, an equivalent of $49,344 per year. If these numbers is anything to go by, a $70,000 salary surpasses the median income by at least $20,000. By such a standard, 70K is a good salary.

How Much is a $70,000 Salary Per Hour?

Many people argue that it’s hard to quantify a 70K dollars annual salary unless you know how much you earn an hour.

So it’s important to look at the hourly wage and compare it with the median hourly rate that many Americans make.

Here’s a summary table:

| Period | Salary in USD |

| Yearly | $70,000 |

| Monthly | $5,833.33 |

| Bi-weekly | $2,916.67 |

| Weekly | $1,458.33 |

| Daily | $208.33 |

| Hourly | $8.68 |

As of this writing, the average hourly rate in the United States of America stands at $7.25.

The average hourly rate for someone earning a salary of $70,000 a year is $8.68.

How Much is a $70K Salary After Taxation?

When we talk about a $70K salary, we refer to the pre-tax income also known as the gross income. The amount you take home is the net income, which is gross income less taxes.

So how much exactly do you earn post taxation?

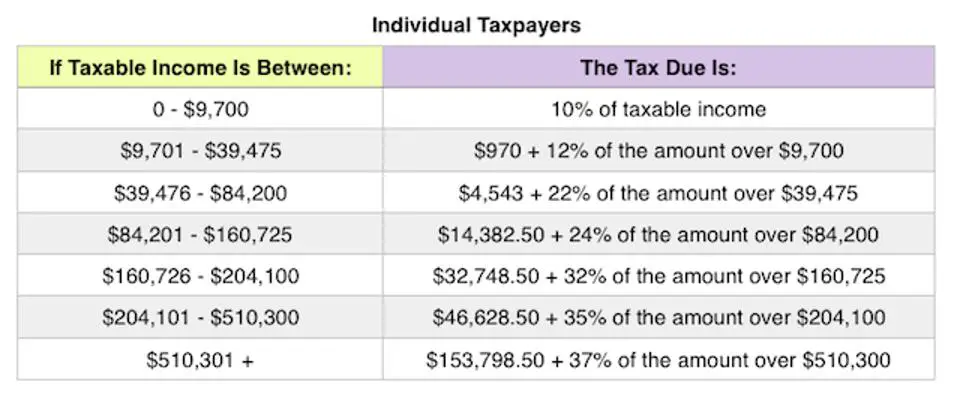

Well, it depends on the tax bracket within which you fall.

The federal government has several tax brackets, which are 10%, 12%, 22%, 24%, 32%, 35%, and 35%. You fall in the 24% tax bracket if you make $70,000 a year, which means your annual tax will be $16,800.

Your net pay will be $53,200, unless you have additional employee benefits that require annual deductions.

It’s important to keep in mind that the tax rate varies from state to state. So check how much the taxman will demand from you every year based on your demography.

Is 70K a Good Salary If You Live In The United States?

Since the median annual salary in the US is $49,344 on average, $70K is generally a good salary for most people. However, basing our conclusion on the median income, without looking at individual preferences puts us in a position of guesswork.

Remember, whether you find a salary of $70,000 good enough or otherwise will depend on a number of factors, and they’re as follows:

1. How Much Money Makes You Happy

People say that money can’t buy happiness. And while we can agree with that beyond any reasonable double doubt, it’s equally true that you need to make a certain amount of money every year to be happy.

In other words, are you happy with your annual income or would you be more comfortable if you made more?

While money is certainly not everything in life, you will need a certain threshold to live on. At the very least, you should be able to pay your bills and have some money left for savings and recreation.

Depending on where you live and what your monthly spending habits are, a $70,000 annual salary can be an amount that makes you happy and contented – or not happy at all.

The problem with money seems to have always been the same, though. People never feel like they have enough even when they earn more. So while it’s hard to quantify exactly how much money can make an individual happy to begin with, it’s highly likely that $70K can be a good salary if you learn to live within your means.

2. Work and Life Balance

Work-life balance is an important factor to consider when deciding whether $70K is a good salary.

First, consider how much time you have to put in every day to make that much money.

- How many days do you work a week?

- Is your job flexible by any means?

- Do you ever get time to spend time with family and friends?

Time can make a great difference.

If you’re working many hours a week to earn $70,000 a year but you know of an opportunity that can make you more money with an equal amount of time, $70K may be less significant.

Second, determine what your life’s goals are. Is the money you make in your current job enough to meet those goals within a given period? Or would you have to consider negotiating your salary – or getting a job that pays more?

Third, would making more money give you the kind of life and work balance necessary to live a better life? For example, if you would like to make $95,000, an additional $25,000 is going to make a difference. But you’d have to do more work, perhaps manage more people, and be with your family less.

So what gives?

Well, it depends.

If making extra money by working more hours and taking more responsibility is worth your time, $70,000 may not be a good salary. However, if you need to work and equally spend enough quality with your family, a $70K salary may be good for you.

3. The Cost of Living

The cost of living differs from state to state, and this has a direct impact on whether $70,000 is a good salary or otherwise.

For example, someone who lives in Wayne, Berrien, or Jackson County in Michigan is highly likely to live more comfortably than someone who lives in California or Washington DC.

In Michigan, the average rent for a two-bedroom house is $9,000 a year. So an individual earning $70,000 pre-tax can do thrive here. Even an annual salary of $60,000can be enough to live what might seem like a luxurious life in Michigan.

It’s a completely different case for people that live in expensive states. If anything, $70K isn’t going to be enough for someone who lives in Los Angeles or DC because monthly rent alone is as high as $2,500 t $4,000 for a two-bedroom apartment.

The CNN’s Cost of Living Calculator is a well-built web technology that can help you determine which state you can live in comfortably if you earn $70,000 pre-tax a year.

4. Debts

Assuming you fall in the 25% tax bracket, you’ll take home $53,200 every year, which is $4,433 in monthly earnings. Whether $4,433 is good enough to live on before your next paycheck will depend on if you have pending debts to pay.

You’re going to burn out financially fast if you have debts such as credit cards, student loans, and personal loans. But you should do fine if you don’t have any or all of these debts to clear.

Assuming you have debts, you really don’t have to feel bad about it either. You can make proper financial plans that help you live on $4,433 comfortably while easily paying off the debts.

5. Monthly Expenses

It’s hard to know if $70K is a good salary to live on if you don’t know how much your monthly expenses are.

The best way to know how much you spend per month is to go through your bank statement in detail. Using the details of your bank statement, create a list of essential and non-essential transactions that you made in the previous months.

Get the total of essential and non-essential expenses and compare them with your post-tax monthly salary.

If your monthly expense is more than what you earn, you’re living beyond your means and it’s therefore necessary that you cut on the non-essential spending.

We don’t mean that you stop going on vacations or stop spending money on clothing and gift. You can find cheaper options to get an equal amount of pleasure, like booking cheap vacations and buying expensive clothes when brands run their promos.

Is $70,000 a Good Salary for a Single Person?

A single person in our case is someone who lives alone and doesn’t have anyone depending on them for financial support. In other words, you don’t have a wife and kids looking up to you, and your parents don’t depend you for a little something extra.

If you’re in this situation, an income of $70,000 annually pre-tax should be enough for you. In fact, provided you have sound financial discipline, you should be in a good financial shape year after year.

Also, you should consider living in an affordable state such as West Virginia and Alabama. By doing so, you’ll find it easy to save a lot of money, which you can invest in business and make even more money.

We strongly recommend using the 50-20-30 budgeting technique. Ideal for all kinds of salaries, the technique requires you to spend 50% on essentials, 30% on whatever you want, and 20% on savings. The idea here is to make sure you cover for your expenses first, save money for the future, and live your life to the fullest.

You’ll find it easy to invest, save, pay off student debts, and improve your credit score if you use the 50-20-30 budgeting technique.

Final Thoughts: So Is 70K a Good Salary?

As we’ve said before, the best way to determine if 70K is a good salary is to look at your lifestyle, spending habits, and demography.

While a salary of $4,433 is enough to cater for your basic needs if you live in West Virginia as a single person, it won’t be enough if you have a family of four depending on you. Again, the amount can’t even pay a month’s rent in DC, so living in such an expensive state can be nothing more than a nightmare.

The most important thing to have in mind is that you have to consider living within your means. In other words, your sum of essential and non-essential transactions should not exceed what you earn.

This monthly income is $5,833.33.

A salary of $70,000 per year is enough to live comfortably in most parts of the United States. However, the cost of living can vary greatly depending on the location, so it is important to take into account the specific area in which you live.