Whether you’ve just started a $50,000 a year job or you intend to apply for one, the rising cost of living will make you question whether the amount can be enough to live on every 12 months. So is 50K a good salary, or do you need an additional income stream to live comfortably?

50K might be a good salary (or not) depending on where you live, your marital status, your future financial goals, and your current cost of living. This may be fine for one person who lives in a low cost state, but it can be a stretch for a family of three or four, even in low cost states.

The type of life you can afford with $50,000 a year goes beyond your marital status. You even have to examine your spending habits to determine whether you’re using more money than you make every month.

This guide looks at some factors that can help you determine whether $50K would be enough to live on every year. Where possible, we’ll give you some examples for more insight and clarity.

How Much is $55K a Year Hourly?

It’s hard to determine how much money you make from your employment if you see it as a lump sum cumulated over the last 12 months.

You need to know the hourly rate and then multiply that by the number of hours you work per day to get your daily average.

Using an approximation, or an educated guess, a salary of $55K a year is $4,583 a month, $1,058 a week, $211.6 a day (for someone working 5 days a week), and about $8.82 an hour before tax deduction.

The current minimum hourly wage in the United States of America stands at $7.25. So, anyone making an average of $8.82 an hour or $211.6 a day before tax deduction isn’t badly off.

How Much is $55,000 a Month Before Deduction?

How much you pay for tax will vary depending on your state’s tax regulation, tax bracket, and the number of taxable deductions (or benefits) that you get from your place of work.

Still, we can do some simple calculations to determine how much money you take home.

The 2021-2022 Federal Income Tax Bracket shows that employees earning $40,526 to $86,375 pay a tax of $4,664, with an additional 22% of any amount of over $40,525.

These numbers can be somewhat confusing, so let’s break it down further for you for more clarity:

| Actual Income | $55,000 |

| Tax Amount Charged | $4,664 |

| Amount After Deduction | $50,336 |

| Amount over $40,252 | $50,336 – $40,525 = $9,811 |

| 22% Deduction | $2,158.42 |

| Total Annual Tax | $6,822.42 |

| Total Net Annual Salary | $48,177.58 |

As you can see, the total taxable income that you’re more likely to pay if you earn a salary of $55,000 is $6,822.42.

Your net salary is $48,177.58, which means you’ll earn approximately $4,015 per month.

Look at the table above once more, again based on your tax bracket, and you should be able to understand how we arrive at the numbers.

How Much Do I Have Left to Spend After Taxation?

If you’re getting a salary of $55,000 a year, you have $4,015 per month after taxation to live on before your next paycheck.

A monthly salary of $4,015 isn’t a lot. But for someone who has mastered the art of financial discipline, the amount can make a big difference.

How to Determine if $55K is a Good Salary

The answer to whether $55,000 is a good salary isn’t something cast in stone. And if we’re being honest, $4,015 can be enough or insufficient to live on per month, depending on several factors.

Here’s what you need to consider:

1. Cost of Living

There is more to the cost of living than just the monthly house rental. And this is true whether you live in the United States of America, Canada, or anywhere else.

The most important things to look at when examining the cost of living include housing, foodstuff, utilities, transportation, and dependency.

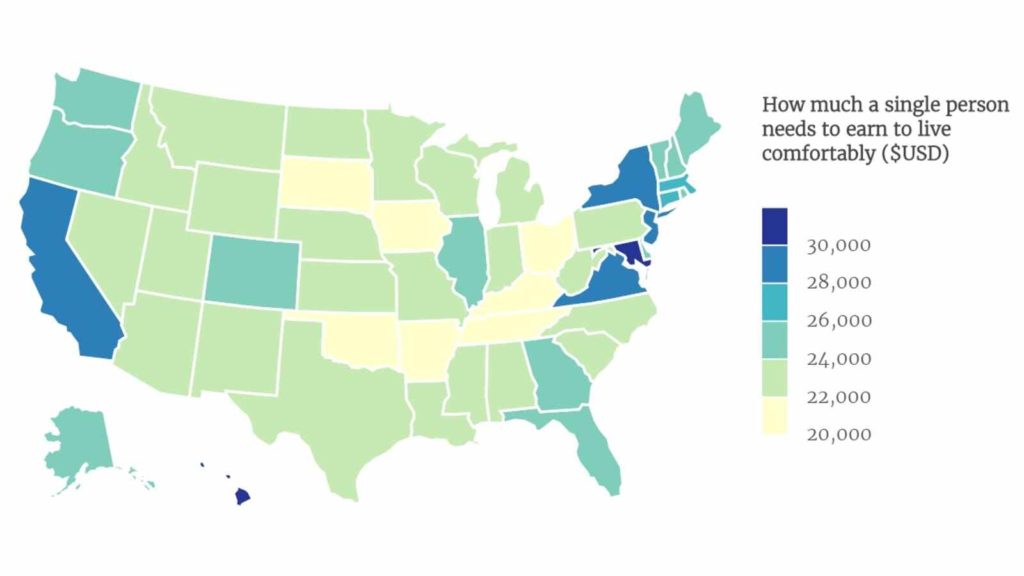

a) Location

Look:

$4,015 isn’t bad money for a monthly salary, but it can’t afford a life in the most expensive cities in the United States of America.

The monthly housing cost in states such as Los Angeles, New York, and Washington D.C. is high, averaging about $2,500.

While you can afford to pay that much for a two-bedroom house, you’ll have about $1,515 left to spend before your next paycheck. If anything, you’ll have to stretch yourself so much that living a comfortable life might become difficult.

With a salary of $4,015 per month, it would be best to consider living in an inexpensive state such as West Virginia, Michigan, and Alabama.

In Michigan, for example, you can rent out a two-bedroom apartment for $700 to $1,000 per month and still have a balance of up to $3,315 to live on before your next paycheck.

b) Foodstuff

Many households in the United States spend about 60% of their food expenses on meals and snacks at home and 40% on eating out.

Still, there are ways by which you can stretch your food budget.

For example, you can buy food directly from the farmer’s market rather than from the supermarket to cut food costs.

Food from the farmers’ markets has a significantly shorter journey from the field to the plate than food from your local grocery store, which is more environmentally friendly and frequently cheaper.

If you prefer to shop at a grocery store, moving to a less expensive location in your neighborhood might help you save money on food every month.

c) Utilities

The cost of gas and electricity also varies from state to state. More often than not, it’s the transportation and transmission expenses and the consumption rates that determine the overall cost of electricity and gas.

We strongly recommend that you compare the costs of different states to help you determine who father you’d have to stretch your $4,015 monthly salary.

d) Transportation

Unless you work from home or live in a place where you can walk to the grocery store or a mall, you’re going to commute from time to time – and it’s going to cost you money almost every day.

So you have to work out the cost of owning a car for a year, find out how much public transportation will cost for the same period, and then weigh your options accordingly.

By weighing your options, you’re not only able to determine whether it’s cheaper to live in your current state but also budget for your transportation.

e) Dependency

Dependency, in our case, refers to the number of people looking up to you for financial support.

If you’re a single person, you’ll only have to worry about rent, food, transportation, and a few utilities here and there. On the other hand, if you have a family to take care of, you’ll end up spending more money and saving less every month.

One thing to consider when it comes to dependency is childcare. If you have kids to take care of and a day job that equally requires your attention, you will have to consider moving to a state where the housing and childcare costs are within your budget.

As an example, the cost of childcare in New York and Massachusetts is higher and often suitable for someone who gets a salary of 200K. States such as Louisiana and Tennessee, on the other hand, have affordable rates for childcare.

2. Debts

Debt will deplete your $48,177.58 paycheck, leaving less money for other expenses.

Consider shredding your credit cards or handing them to someone that you trust to ensure you only use them during an emergency.

Remember that eliminating the urge to spend unnecessarily is critical to budgeting and saving successfully.

3. Your Spending Habits

Your spending habits will directly impact how you use your monthly salary.

Look at your bank statements and note all your spending patterns. These may include the following:

- Excessive cell phone usage

- Impulse purchases

- Eating out more than you even should

- Spending without planning – or keeping track

- Taking friends out for shopping to make them happy

You get the idea, don’t you?

Concentrate initially on the two largest areas where you cannot stop spending. Once you’ve halted spending in one area, proceed to prioritize your list of problematic spending habits.

Doing so will help you manage your finances well and make it easy for you to live well on a $55,000 annual salary.

The Kind of Lifestyle You Can Afford With a $55K Salary

An average American earned around $51,480 in 2021.

So if you’re someone in a job that makes you 55,000 dollars a year, you can live comfortably and even save money if you have good spending habits and works with a budget.

A good monthly budget for someone on a $55K salary can look something like this:

- Housing: $1,000

- Bills: $400

- Car: $350

- Insurance: $200

- Phone: $50

- Food: $350

- Personal: $250

- Entertainment: $235

The above is just an example, but at least you get the idea of what you can afford with a salary of $4,015 per month.

Budgeting is critical regardless of whether you earn $55,000 or make $100,000 per year. If you truly want to achieve your financial goals, you will need to have a budget plan that you use every month.

A tight budget plan can help you determine how much money you make, how much money you need to spend on outgoings, and how much money you can save.

Without budgeting, you will have no idea how much money you spend every month, and you will more than likely assume that you have a lot of money in your bank account.

Final Words: ”Is 50K A Good Salary?”

We can’t stress enough that the cost of living is what will ultimately determine the kind of lifestyle you can afford now that you’re making $55K or looking to start a job that pays you that much.

The most important thing to remember is that financial independence doesn’t come from how much money you earn but from the amount you save for future investments. In addition to living within your means, focusing on saving a percentage of your income will help you have a better future.

This will depend on where you live, your marital status, your future financial goals, and your current cost of living. This may be fine for one person who lives in a low-cost state, but it can be a stretch for a family of three or four, even in low-cost states.

Yes, it is possible to save money while living on $50,000 per year. It requires budgeting, prioritizing expenses, and making conscious choices to reduce unnecessary expenses.