The cost of living in America goes higher every year, and with that comes the demand to make more money to live a comfortable life. If you’re just getting started with job hunting, and you’ve seen an opportunity that pays $40,000 a year, it’s more than likely that you have questioned whether the money would be enough. So is 40K a good salary?

A 40K salary is below average by America’s current standards. It’s going to be enough for a young, single adult to live on throughout the year. But it won’t be sufficient for someone who has a family to support from the period of one paycheck to the next.

Money is always going to be an important factor to consider when settling for an employment. So, even if you have a passion for a job but it doesn’t pay well, it may not be worth the effort.

Think about it:

You have monthly bills to pay, retirement to fund, debts to clear, and a life you want to afford. So if there’s a $40k job that seems to have piqued your interest already, you first have to determine of the salary would be good enough for you.

40K a Year Is How Much an Hour?

The best way to understand your wage is to break it down into parts. It makes sense to do that because you aren’t going to get a single payment of $40,000 every 12 months. Depending on your employer, you may get a payment on an hourly, daily, weekly, bi-weekly, or monthly basis.

If you’ve landed a job that pays $40,000 a year – or you consider taking one that pays this much – it’s important to break the amount down to know your hourly wage.

Here’s a table breaking down how much $40,000 a year is in an hour:

| Salary Duration | Amount Earned |

| Per Year | $40,000 |

| Per Month | $3,333.33 |

| Biweekly | $1,538.46 |

| Per Week | $769.23 |

| Per Day | $153.85 |

| Per Hour | $19.23 |

Keep in mind that this is the gross income for someone earning $40K a year, not what they take home. What you get is the net salary, which is the amount you earn after tax deductions.

Also, note that these values are estimates based on the 52-week calendar, 5-day workweeks, and 8-hour workdays.

How Much Rent Can I Afford With a Salary of $40,000 in the U.S.?

We understand that the cost of living is the single most valuable factor to consider when determining if 40K is a good salary. So before you take that job, you have to determine how much exactly it would cost you to qualify as a monthly renter in the United States.

There are two thing you need to do determine the cost of rent.

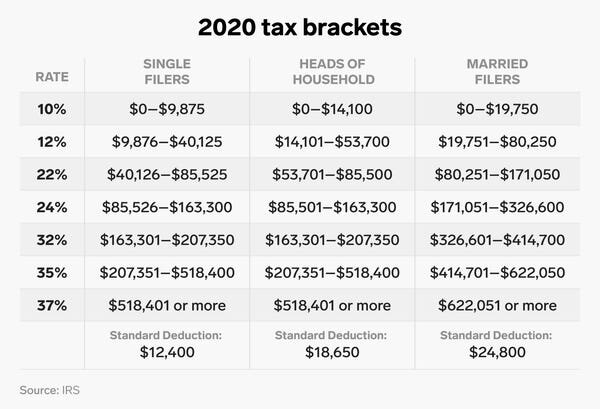

1. Check How Much Tax You Have to File Based on Your Tax Bracket

First, look at your tax bracket to determine how much money you take home after monthly deductions from your salary.

Based on the Federal Income Tax Bracket due in April 2022 or in October 22 (with an extension), an employee who earns a salary of $40,000 a year pays an income tax of $995 with an additional 12% of any amount over $9,950.

We understand that these numbers can be somewhat confusing.

So here’s a summary table to help you understand the math without thinking so hard:

| Actual Income | $40,000 |

| Tax Amount Charged | $995 |

| Amount After Deduction | $39,005 |

| Amount over $40,252 | $39,005 – $9,950 = $29,055 |

| 12% Deduction | $3,486.6 |

| Total Annual Tax | $4,481.6 |

| Total Net Annual Salary | $35,518 |

The total net salary of $35,518 is the amount you’ll take home as your annual salary. Depending on the number of hours you work per week, $35,518 year is about $2,960 per month.

2. Decide Where to Live Based on Your Monthly Salary

Now that you know you take $2,960 home per month after taxes, the next step is to determine where to live.

Keep in mind that the $2,960 is the much money you have to live on for the next 30 days. So you need to budget your money well to get the most out of this value.

There are limits to where you can live in the U.S with a salary of $40,000 per year, but that doesn’t mean you don’t have options.

To begin with, you aren’t going to do well in expensive states and cities if you’re making $2,960 a month.

The average monthly rent in Northern California, Florida, and Miami, for example, is $2,500. That’s already more than 95% of your salary gone so you simply can’t afford a life here – unless, of course, you have an additional stream of income or look for a job that earns you a salary of $100K per year.

It’s a completely different case if you live in a state where monthly rent for a one and two-bedroomed house goes for under $1,000. Examples of these states include Alabama, Arkansas, Idaho, Indiana, Lowa, Kansas, Kentucky, and Louisiana.

| State | One Bedroom | Two Bedrooms | Three Bedrooms | Four Bedrooms |

| Alabama | $710.17 | $872.42 | $1,059.75 | $1,267.92 |

| Arkansas | $591.03 | $752.33 | $926.33 | $1,100 |

| Idaho | $660.17 | $842.75 | $1,102.83 | $1,250.50 |

| Indiana | $717.42 | $895.83 | $1,052.25 | $1,193.33 |

| Louisiana | $737.83 | $860.67 | $988.42 | $1,178.75 |

| Kentucky | $680.58 | $846.50 | $1,024.92 | $1,214 |

| Kansas | $688.25 | $873.50 | $1,050.08 | $1,240.92 |

Как видите, в США есть недорогие штаты, где вы можете жить комфортно месяц за месяцем, при условии, что вы живете в доме с одной или двумя спальнями.

Of course, you won’t get the chance to enjoy the beauty of the most luxurious states and cities in the United States, but at least you can live within your means and even save money

If you opt to live in a two-bedroom house in the inexpensive states, you’ll more than likely pay around $900 a month. With $2,000 left, you should do just fine from paycheck to paycheck.

On average, a person earning $40k per year might afford to pay up to $1,111 for rent. And, if they live in an inexpensive state, it means they can comfortably pay for a one to three-bedroom house every month.

This is consistent with the principle that your monthly gross salary must be equal to or more than three times the cost of rent.

We recommend that you pay rent or mortgage with no more than 25% of your monthly gross income. This implies that because you earn about $2,900 per month exclusive of tax, your rent should be around $800 give or take.

What’s the Best Way to Live on a 40K Salary?

Here’s the deal:

It doesn’t matter whether you make $40K or get a salary of $70K and above. The much you get won’t matter if you can’t manage money wisely.

More often than not, people that aren’t good stewards of their money often end up bankrupt or in extreme debts. And that’s the last situation you ever want to find yourself.

At Financial Creatives, we often encourage our readers to develop money habits that can help them live on what they have. So here are some tips to help you get the most out of a $40K salary:

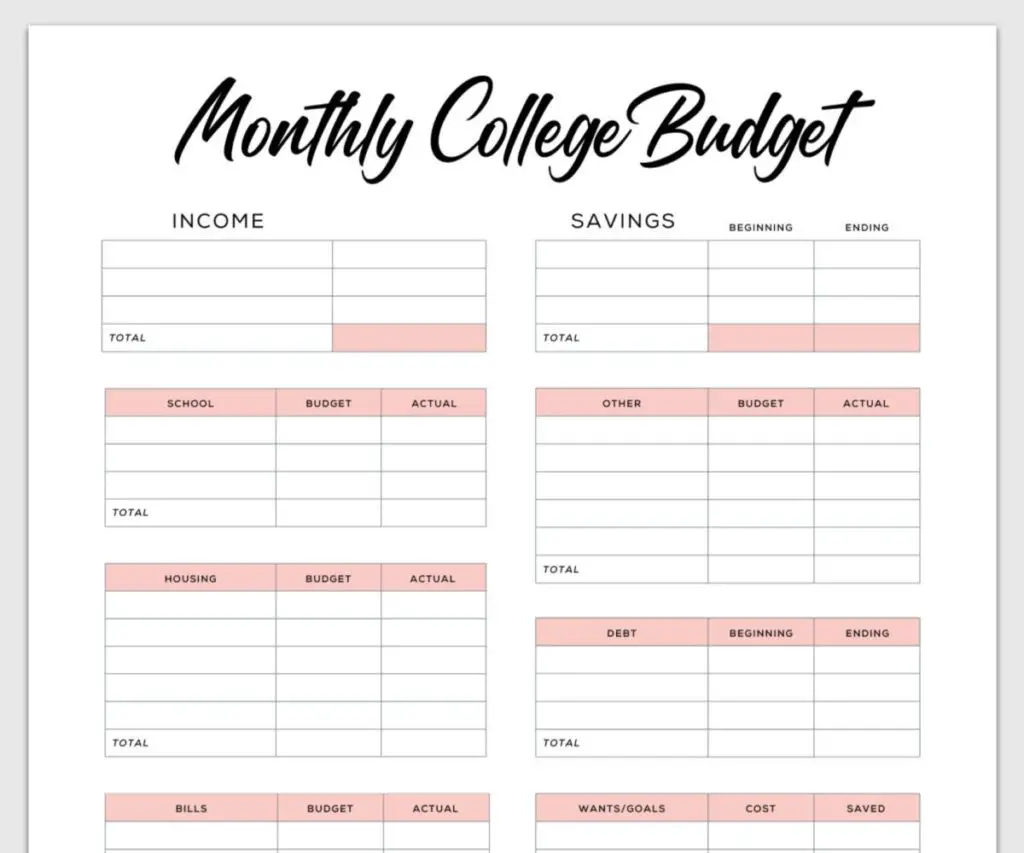

1. Budget for Your Money (And Do So Appropriately)

Understanding how to budget is the first step toward maximizing the value of your money.

While $40,000 may appear to be a large sum of money, you’ll find yourself overspending and ending up broke even before the month ends.

Budgeting your money and determining how to spend every dollar is equivalent to giving yourself an instant raise. At the end of the day, you’ll end up spending your money only on the things that matter.

2. Pay Off Your Debts

Debt is the scourge of affluence, because there’s no way you’re going to become wealthy if you’re perpetually in debt. Take it from us when we tell you that debts can easily rob you of your future – and do it so fast.

If anything, the interest payments on your debts can easily erode all of your attempts to save and build your money. So the best thing to do is to have a repayment plan that can help you resolve current debts. Then, you should incurring more debts in the future.

3. Live Your Life Within Your Means

To live within your means, you must first be satisfied with what you already have. There will always be something newer or perceived as superior, but you need to avoid the temptation of trying to keep up with the latest trends.

If you’re continuously on the lookout for new automobiles and status symbols, you’ll have little money left to save.

To be abundantly clear, there’s nothing wrong with having fun. But if you’re going to spend a larger percentage of your money on it, it won’t be worth it.

4. Don’t Spend Money You Don’t Have

Credit Cards are just as good as they can be detrimental. We have nothing again them, but if you constantly find yourself using your credit card, you’re likely a slave of spending money that you don’t already have.

Except in the event of an emergency, we strongly suggest that you don’t use your Credit Card at all. That way, you’ll stay out of debt, live on a salary of $40K just fine, and even save some money for the future projects.

5. Cut Down on Your Expenses

Once you’ve established a budget, you’ll see exactly where your money is going. Then, look for strategies you can use to cut down on cost.

For example, buying convenience foods or coffee won’t make you poor. But if you prepare your own coffee and meals at home, you can save four figures every year.

You can downgrade your TV subscription, eat out less, switch to cheaper mobile carriers, and use coupons to shop in bulk.

The idea here is to look at your spending patterns and then do an evaluation to see what you can do to lower cost.

Final Thoughts: Is 40K a Good Salary?

An income of $40,000 a year should be good for you if you know how to manage it. Keep in mind that there are cities where that pay is ideal for you, and cities where it is not. So, consider the typical cost of living in your location when calculating your costs.

In general, if you live in an area with a low cost of living and manage your finances well, you should be able to avoid as much debt as possible and even save money for future projects.

There are low-cost states in the US where you can live comfortably month after month, as long as you live in a one- or two-bedroom home. Examples of these states include Alabama, Arkansas, Idaho, Indiana, Lowa, Kansas, Kentucky, and Louisiana.

To calculate the hourly rate based on an annual salary of 40,000 dollars, you can divide the annual salary by the number of working hours in a year. Assuming a standard 40-hour workweek and 52 weeks in a year, the calculation would be: 40,000 dollars / (40 hours/week * 52 weeks/year) = $19.23 per hour.