The median household salary in the United States of America currently stands a $60,000 a year. That’s three times the annual salary of someone making $20,000 every 12 months. But is 20K a good salary if you live in the United States or should you look for additional streams of income?

20K may be a good salary for someone living alone. But it’s not enough to give you the most comfortable life. You won’t have many options on where to live either. The $20,000 salary won’t be enough if you have a family. So you’ll have to look for an additional stream of income to make ends meet.

Many single persons, especially those still living under their parents’ roof or share house cost with friends, can live on a 20K salary and do okay. Of course, they won’t live the most comfortable life, but at least they can get by if they live in cheap state such as Michigan and Alabama.

Is 20K A Good Salary If You Live in the U.S.?

There are X factors to consider to determine whether $20K is a good salary in the United States. These are:

- Federal Income Tax

- Demography

- Marital Status

- Your spending habits and

- Your marital status

- Debts

Let’s look at each factor in detail.

1. Federal Income Tax

We start with the Federal Income tax because it is what determines how much money you take home after the deduction.

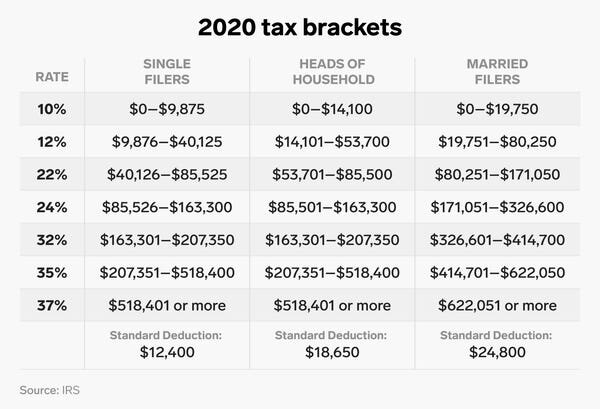

To begin with, being in a tax bracket doesn’t mean you’ll you pay the Federal income tax on every dollar you make. The bracket reflects a progressive tax system where people with higher income pay more federal income tax rate and those who earn less are subject to lower taxes.

An employee who makes $20,000 belongs in the 12% tax bracket. Essentially, employees who make between $19,901 and $81,050 pay $1,990 plus 12% of any amount above $19,900.

So after tax deduction, you’ll have $18,810 to live on every year, which essentially means that you earn $1,500.83 per month.

2. Demography

With $1,500 to live on every month, it doesn’t seem like you have many options on where to live.

Think about this way:

The housing cost in some states, including Los Angeles, Las Vegas, and Washington D.C., falls between $2,500 and $4,000 per month.

In a year, you’d have to set $30K to $48K aside for rent alone. So a $1,500.83 monthly salary won’t make the cut.

It’s a bit of an ease if you choose to live in inexpensive states such as Idaho, Oklahoma, Georgia, and Ohio.

In Idaho, for example, you can rent a two-bedroom house for $600 to $800 and have anything between $700 and $800 to live on every month.

Michigan is another inexpensive state where rent rates are fair for low-income earners. You can pay as low as $500 for a two-bedroom house and have $1,000.83 left to live on.

The takeaway here is this:

There are states where an income of $1,500.83 just won’t be enough. And there are states where you’ll do okay on a salary of $20,000 a year.

3. Marital Status

Whether you can survive on an annual salary of $20,000 also depends on your current marital status.

On the one hand, $20,000 a year may be enough for a single person, especially if they’re out of college and still living with their parents.

$20K may also be a good salary if you’re a single person who share a house with friends and cost share the monthly rent. Here, you pay less money for rent every month, and you will more than likely save a few dollars every month for your future projects.

It’s a different case if you’re married – or married with kids.

You have $1,500.83 a month left to spend after taxation. That’s not enough money to take care of one person, leave alone a family.

Even if you pay $600 to $800 for a two-bedroom house in Alabama, Michigan, Idaho, Ohio, or West Virginia, you’ll have very little left to cater for your family needs.

Given just how little $1,500.83 is, you’ll need an additional stream of income to take good care of your family.

4. Your Spending Habits

Some people are able to live on $20K a year comfortably. For others, the amount doesn’t seem to be enough.

The difference is in the spending habits.

If you like to:

- Go shopping with friends

- Buy items you don’t necessarily need

- Misuse your credit card

You’ll end up broke even before the month ends. And that can’t be good for your physical and psychological wellbeing.

On the other hand, if you take financial planning seriously, and you work with a monthly budget, you should do okay month after month.

You won’t save a lot of money, but financial discipline can go a long way to keep you from the stress that comes with debts and lack of food and shelter.

5. Your Financial Goals

Financial goals, in this case, refer to the projects you’d like to complete within a given period with the money that you save from your monthly or annual salary.

Since you make $1,500.83 per month, it’s going to be difficult to set and meet short-term goals first.

If you think about it, you’ll pay an average of $800 per month for rent, leaving only $700 to spend before your next paycheck. Unless you have an additional stream of income, your only option may be to set 5 to10-yearg goals, so you can save enough money to finance your projects.

6. Debts

Another factor that determines whether $20K would be enough to live on every year is debts. From credit card to student loans, debts can affect your overall annual income in a bad way.

Again, you’ll need to look for an additional source of income if you want to live above the survival level. Also, create a monthly repayment plan to help you clear your debts with time.

Another recommendation is that you try your best to keep away your credit card or limit its usage, because it can have a negative impact on your credit score and overall your life.

20K a Year is How Much An Hour?

Now that we’ve looked at the factors that determine whether $20,000 a year is good income, it’s important to know how much exactly you make an hour.

The average American works for 44 hours a week, or approximately 8.8 hours a day. Using this stat, we can find the average hourly rate for someone making $20,000 a year. Then, we can compare that value with the current average rate to see which one is higher.

Here’s a table that summarizes how much $20K a year is in an hour:

| Period | Salary |

| Yearly | $20,000 |

| Monthly | $1,666.7 |

| Biweekly | $833.35 |

| Weekly | $416.7 |

| Daily | $69.45 |

| Hourly | $7.9 |

The hourly rate on the table above is the daily average rate earned divided by 8.8 hours, which is the average number of hours that Americans work per day.

Now:

The current average hourly rate in the United States of America is $7.25. So the hourly rate for someone who makes $20K a year is only $0.65 higher, which doesn’t make much difference.

If anything, you’re working for the minimum hourly wage possible if you earn $20,000 a year. And depending on your marital status, lifestyle, current cost of living, and spending habits are, you may need to find an additional source of income to live a comfortable life.

Is It Possible to Live on $20K a Year?

Yes, you can, but you won’t be as comfortable as someone who gets a salary of $100K and above.

We need to consider three things before we can conclude whether it’s possible to survive on $20K a year: cost of living and marital status.

Why?

Because cost of living and marital status are the major factors that influence how much you spend and how much you can save.

First, determine how much you have to pay for rent. You don’t have to pay anything if you live with your parents, so it’s possible to save money. It’s also possible to have extra cash to spare if you cost share rent with a friend or two.

Remember, though, that you don’t have a many options when it comes to where to live if you make $20,000 a year. You’ll only do well in inexpensive states where rent goes for $800 or less a month.

Second, understand that you can’t survive on $20,000 a year if you have a family. You’ll have many bills to pay, so you won’t have enough money left to save.

Is $20,000 a Year Poverty?

According to the Federal government, poverty accounts for the income and the number of people in a household. The current average household income is $67,521. That’s more than three times the annual salary of an individual who makes $20K a month.

So, is a salary of $20,000 a year poverty?

It depends.

A family of three or more can’t live on $20,000. The $1,500.83 monthly paycheck is just not enough to sustain this number of people.

So, again, consider looking for an additional stream of income to supplement what you’re already making.

Final Thoughts: Is 20K a Good Salary?

A $20,000 a year salary is below the national average. You’re making just $7.90 an hour, an equivalent of $69.45 a day. That’s only $0.65 more than what an average American make per hour.

To be clear, $20,000 a year isn’t bad money. It’s better than nothing is, and it’s a good starting point for someone who’s fresh out of college. Also, $20K is a decent starting salary if you live with your parents or rent out a house with one or two friends.

$20K is not a good salary if you have a family to take care of. Remember, your gross income is $1,500.83 per month, which is not enough to take good care of yourself, leave alone feed a family of two, three, or four.

So if you’re working a job that pays $20,000 a year, we strongly recommend that you look for an additional income stream so that you can make more money.

This income is sufficient for one person, especially if he graduated from college and still lives with his parents. Or if you are a single person who shares a house with friends and shares the monthly rent.

Living on $20K a year can be tough, but it’s possible if you make smart financial choices and prioritize your spending. Here are some tips to help you live on a budget: create a budget, cut your spending, prioritize your spending, look for ways to increase your income, and so on.